If you’ve heard about FIRS starting e-invoicing in Nigeria and you’re curious about how it works, you’re not alone. Many Nigerian businesses are still trying to understand this new system. Let’s explain it in a simple way using only the basics you need to know.

What is FIRS E-Invoicing?

FIRS E-Invoicing is an electronic invoicing system that allows businesses to generate and submit invoices electronically to the FIRS. It’s basically a digital system that allows the Federal Inland Revenue Service (FIRS) to receive, validate, and track invoices electronically.

Instead of just issuing an invoice from your accounting software and keeping it moving, the system now adds an extra layer: which is that your invoice goes to FIRS → gets validated → gets assigned a unique reference → then you can use it for your transaction.

That’s the whole idea.Who is FIRS E-Invoicing for?

At this moment, this e-invoicing update mainly affects large taxpayers who are the big companies with huge turnovers of billions of Naira.

This will probably grow eventually. It may not happen soon, but it will happen. So even if you’re not a large taxpayer, understanding the process early is a smart move.The foundation of the system: The Merchant-Buyer Model

In simple terms, your system, whether it's an ERP, accounting software, or billing app, sends invoice details to FIRS in a structured digital format. FIRS verifies the information, approves it, and assigns an Invoice Reference Number (IRN).

This IRN is then attached to your invoice, acting as a digital seal confirming that the invoice has been officially recognized.

How does the FIRS e-invoicing process actually work?

1. You create an invoice

2. Your system connects to FIRS automatically

3. The invoice is sent to FIRS for validation

FIRS checks the key details:

Invoice amount

Buyer details

- Merchant details

Tax information

Structure/format

4. FIRS approves it and issues an Invoice Reference Number (IRN)

5. You send the invoice to your customer

Does this update mean you need a new software?

Requirements for FIRS e-invoicing

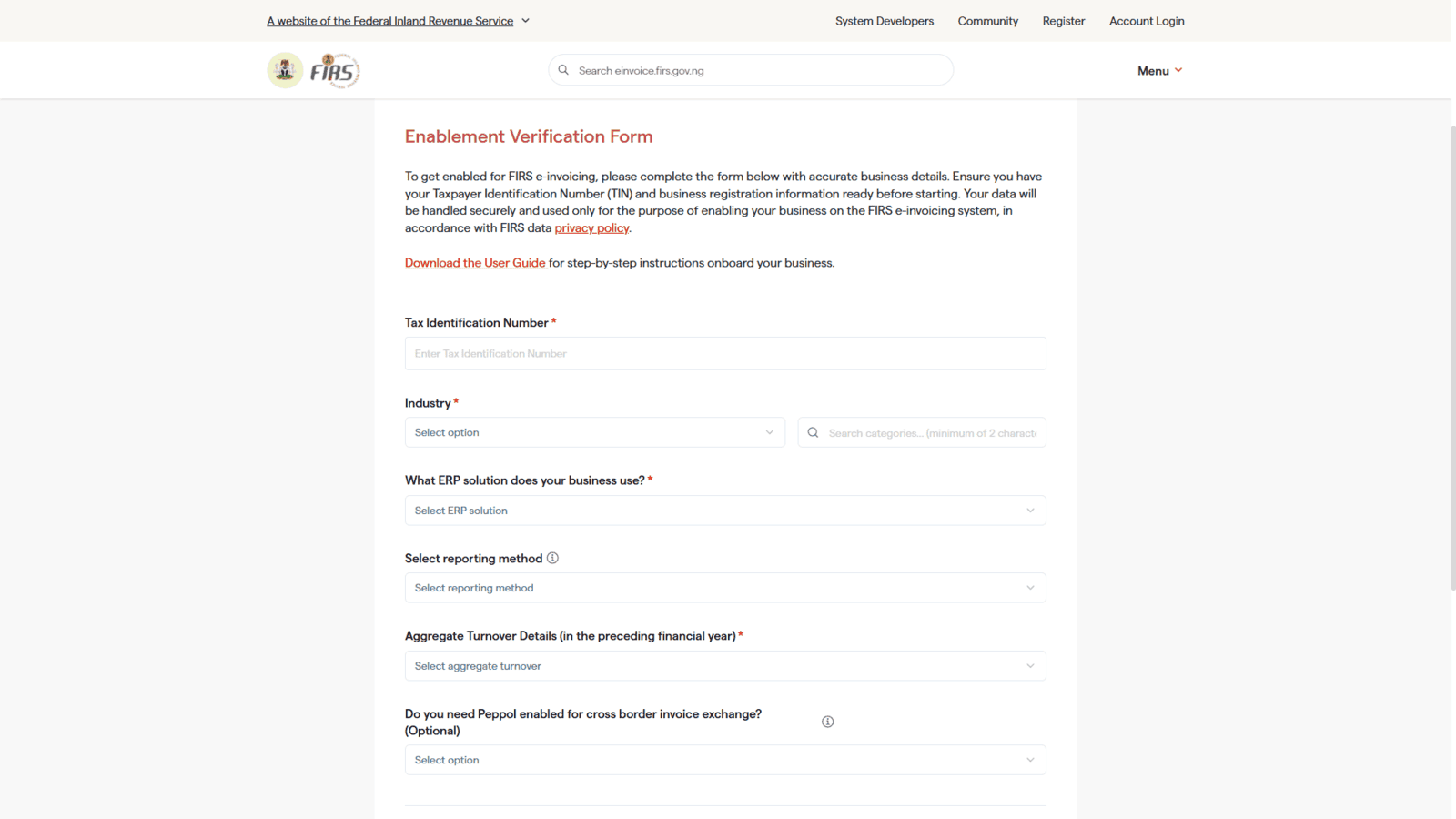

To use FIRS E-Invoicing, businesses must meet the following requirements:

Business must be registered with the FIRS.

Business must have a unique Tax Identification Number (TIN).

Business must have a valid email address and phone number.

Business must have a functional bank account.

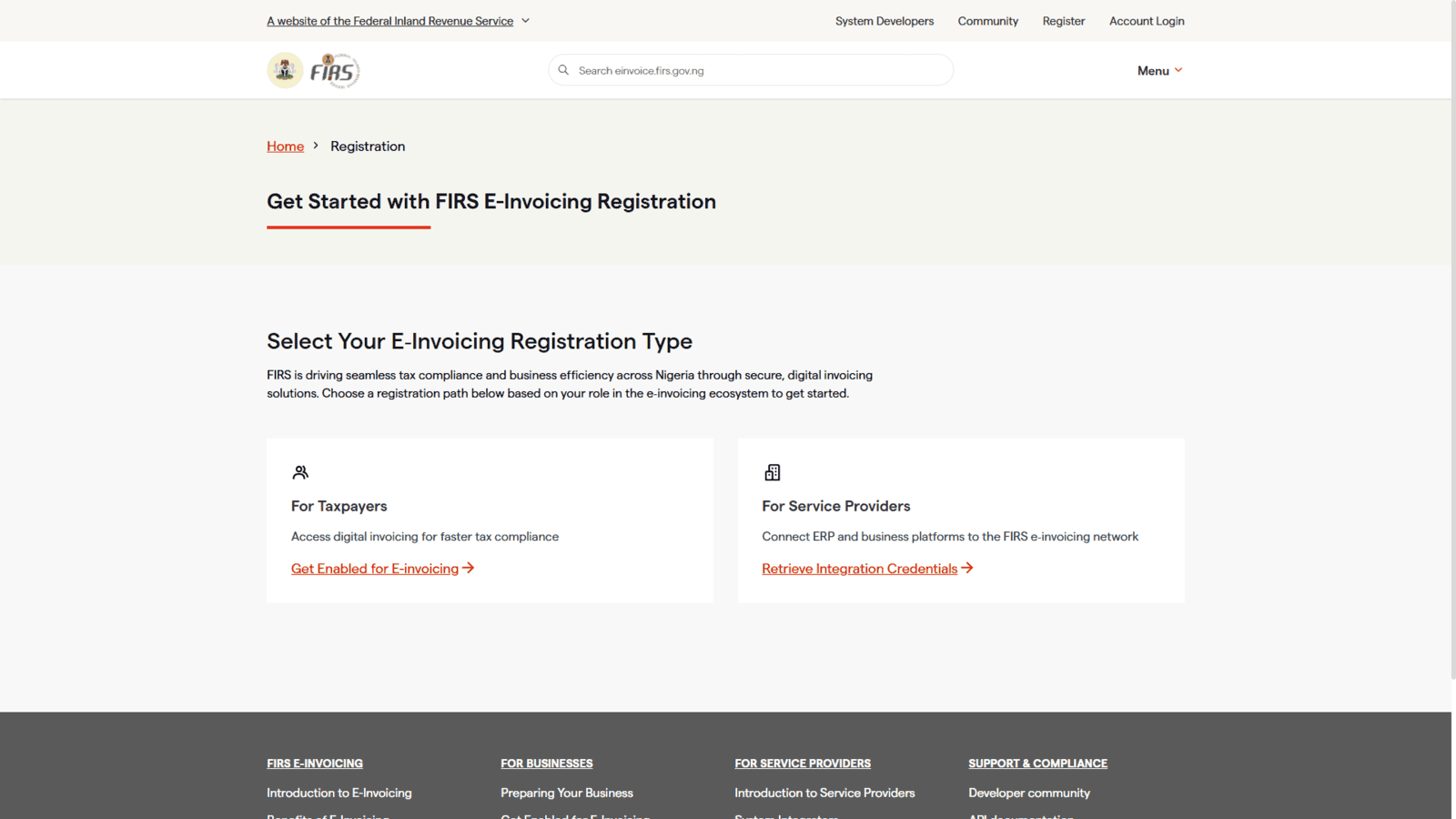

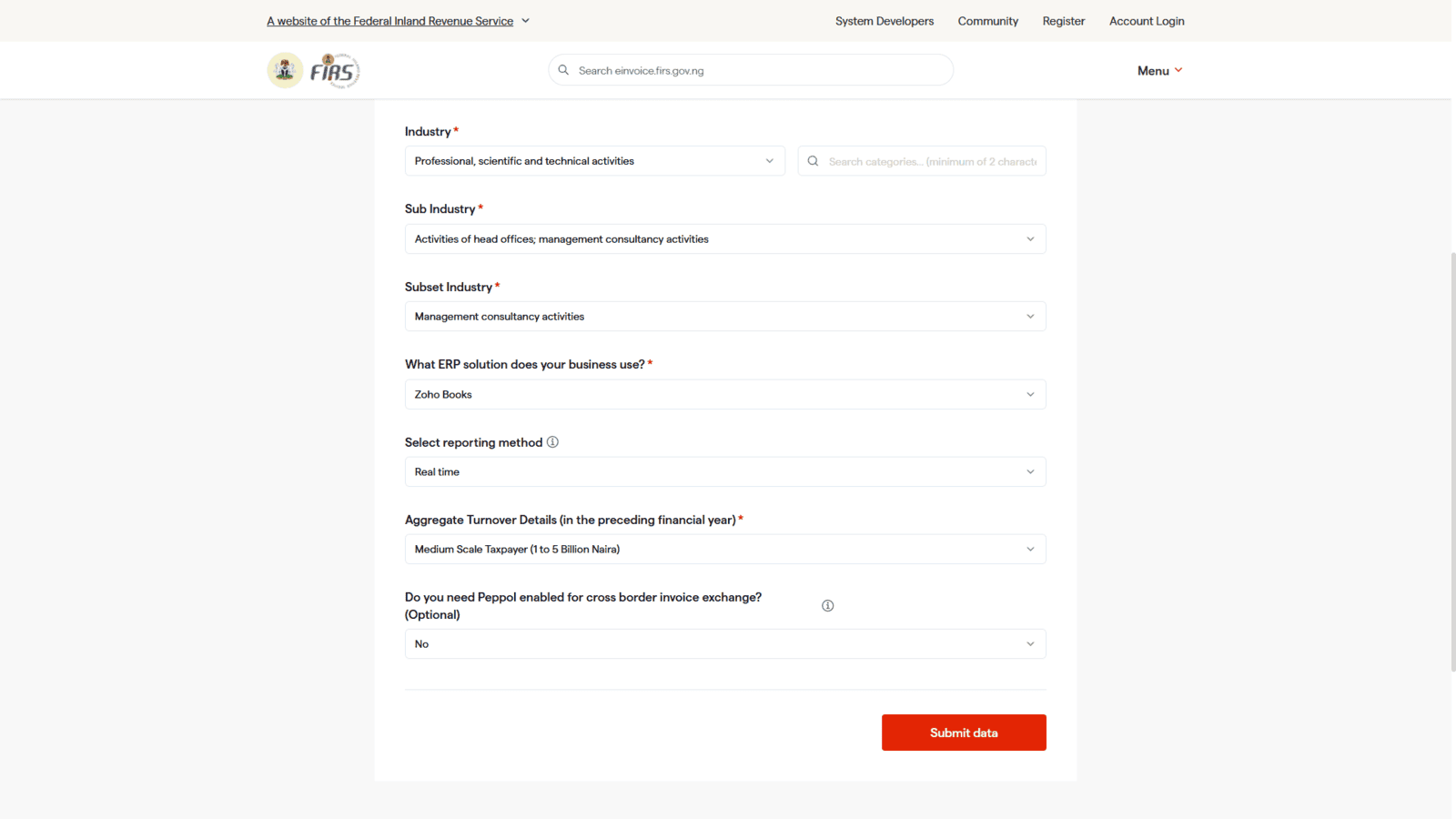

How to register for FIRS e-invoicing?

Once verified, your business will receive a unique identifier and login credentials.

Which accounting software supports FIRS e-invoicing?

- Zoho Books / Zoho Finance Suite

- Odoo

- Sage (Enterprise versions)

- SAP (commonly used by large enterprises)

- Oracle ERP

- Microsoft Dynamics

Conclusion

FIRS e-invoicing is a big move towards going digital with Nigeria's tax system. It's all about streamlining transaction data right from the start.

Right now, it's mainly aimed at the big taxpayers, but we expect it to grow. The main steps are straightforward: you create an invoice, get it checked and stamped with an IRN by FIRS, and then send it out. The key to making it work is making sure your business systems can link up with the FIRS platform, whether directly or through an intermediary.